DIGITAL VISION 2

If you’ve ever wondered what people meant by “crypto is volatile,” this week answered it!

After a sharp drop in Bitcoin dominance, Alts enjoyed a much-appreciated rally, with some getting more love than others. However, just as the parade was getting going, Bitcoin decided to make a small correction and Alts completely fell apart.

But now, with Bitcoin back above $100K, Alts are rallying again... party back on?

Aren’t you glad you’ve got us to break it all down and shine a light on the key moves from this week?

CryptoVerse: Making the Difference in a Crisis – World Mobile (WMTx)

Digital Insight: Dino Coins Surge & Raydium Fees Drop as Capital Flows to Base

DVDealings: How Pendle (PENDLE) and Maker (MKR) Shaped Our Strategy This Week

Strategy Performance

Note: our two strategies can be copied by investors on the ICONOMI platform. Click on the buttons below the charts to check it out…

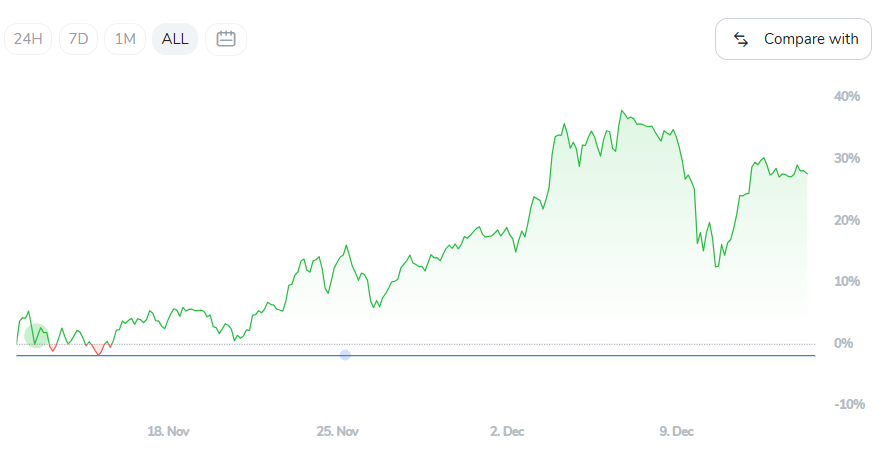

WistCap FLAGSHIP LONG - Best ideas including Bitcoin

WistCap DIGITALVISION - Best ideas excluding Bitcoin

WistCap Flagship Long

+128.9% (since launch 27/11/23)

+1.34% (last 7 days)

WistCap DIGITALVISION (since launch 11/11/24) +26.9%

WistCap DIGITALVISION (last 7 days) -6.1%

Updated portfolios can be seen in the “DVDealings” section at the end of this letter.

CRYPTOVERSE

Starlink gets an Upgrade

Following the aftermath of Hurricane Helene in North Carolina, World Mobile (WMT) partnered with Starlink to help re-establish connection for residents. The collaboration was featured in a documentary released on 10th December.

The film showcases the World Mobile Airnodes and their ability to provide connectivity to residents within 15 minutes. Starlink’s Head of Relief Efforts, Mike Coryell, noted,

“With World Mobile, we only need to deploy 3 Starlinks instead of 20.”

Residents praised the seamless reconnection, which restored communication for over 30,000 people using just four AirNodes. While not featured in the documentary, reports reveal World Mobile extended its services to Valencia to assist in the aftermath of recent floods there. In the words of Mike Coryell,

“These are the most critical locations you could ever deploy this”.

World Mobile’s AirNode network has expanded from 1,078 to 6,441 in just one year with a recent batch of 2,000 AirNodes selling out in just three minutes.

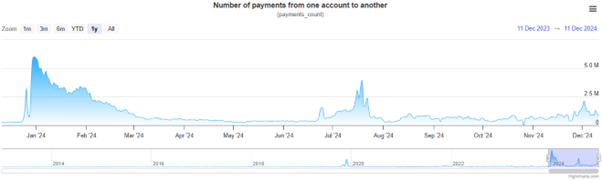

With deployments in Zanzibar, Pakistan, the UK, and the US, World Mobile has over 540,000 daily active users, surpassing Ethereum and becoming the 11th most active network.

Looking ahead, the project appears poised for more milestones. CEO Micky Watkins stated, “We have close to 1 million users on our network”. When recorded on-chain, this would place World Mobile among the top four networks in terms of active daily users.

DIGITAL INSIGHT

Dino Coins Roar Back: Nostalgia or Real Opportunity?

On November 13, so-called “Dino” Coins — XRP, HBAR, Stellar, and Cardano — spiked in unison. At its peak, XRP rose 335%, HBAR 575%, Stellar 440%, and Cardano 150%. Since then, they’ve pulled back 20-35%, compared to a 15% drop in the broader altcoin market.

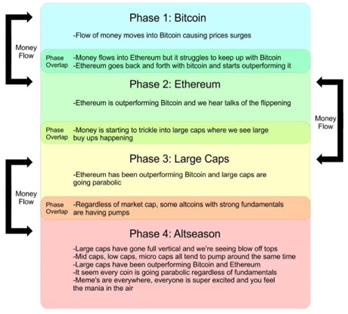

These moves don’t fit the usual crypto cycle. Ethereum hasn’t outperformed Bitcoin, and there’s no more talk of a “flippening” (the moment when ETH overtakes BTC in terms of market cap – ain’t happening). Retail interest could explain part of it, with Coinbase and Crypto.com climbing back into the App Store’s top 100. Returning investors may be buying coins they recognise from past cycles.

Bearish divergences on the BTC.Dominance chart did indicate a move in Altcoins could be imminent but the scale of these moves suggests something more.

News and rumours seem to be driving the price action. The favourable XRP ruling earlier this year and political shifts following Trump’s win, and Gary Gensler’s resignation, have boosted sentiment.

Paul Atkins, the pro-crypto nominee to replace Gensler as SEC Chair, has attracted attention as well. Atkins has a history of supporting blockchain projects and even spoke at the Cardano Summit in 2020. His nomination is fuelling speculation about a friendlier regulatory environment for crypto.

Adding to this is the appointment of David Sacks as the new AI & Crypto Czar. Sacks, a well-known figure in both the tech and crypto sectors, is expected to play a key role in shaping blockchain policy.

There are also rumours about Trump eliminating capital gains taxes on cryptocurrencies issued by U.S. companies and exploring blockchain-based voting systems, with HBAR and Cardano. FedNow’s recent showcasing of Hedera’s Dropp platform has also drawn attention.

It’s clear that these rallies are not driven by improvements in on-chain data or fundamental changes within these projects.

XRP, the token of the Ripple blockchain, has long been a retail investor’s favourite. This is partly because it has been around long enough for people to remember it from the last cycle, and partly because they have cosied up to traditional finance.

Our most recent LITMUS on XRP, in August 2023, scored the token a D. This was due to poor tokenomics, tough competition and regulatory uncertainty. So it doesn’t meet the hurdle for our investment strategies.

While recent political changes have helped, they haven’t resolved these issues. XRP’s circulating supply has increased by 9% since our review, leaving 43% of the supply still locked. Additionally, 41% of the supply is held by the top 10 wallets, raising concerns about concentrated ownership and absence of decentralisation. Demand for XRP services has also shown no consistent uptrend.

We are yet to conduct a LITMUS for Stellar, but its ties to the Ripple Foundation suggest it would face similar criticisms.

Cardano scored an F in our November 2021 LITMUS. We haven’t revisited the project, but its lack of notable updates since then reinforces this score. World Mobile, one of its key projects, has even migrated to other chains, a move that reflects broader concerns.

HBAR received an investment grade score of a B in our September 2023 LITMUS. Its DAG-based consensus mechanism is a standout feature, but competition has only intensified since our review. For now, we believe stronger alternatives exist and aren’t in a hurry to invest.

These rallies appear driven by hype and nostalgia rather than fundamentals. We believe that projects with strong use cases and measurable on-chain demand are the most likely long-term winners.

Battle of the DEXs

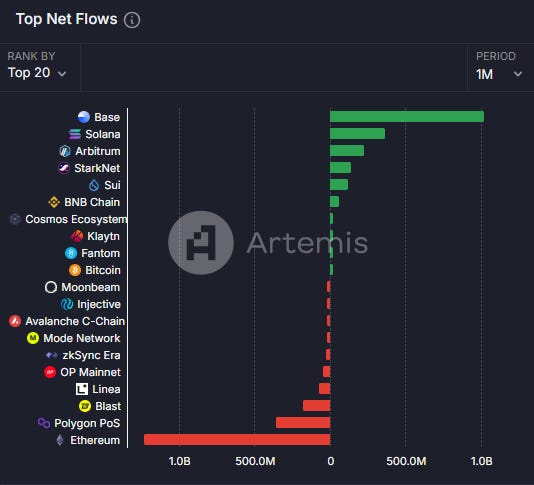

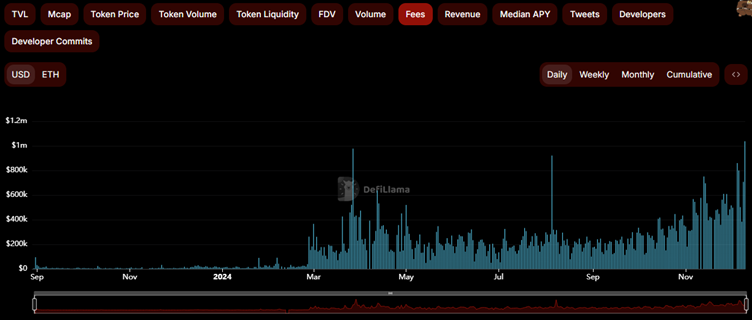

Last week, we highlighted Raydium’s strong performance, however the landscape has shifted. Recent developments at Pump.fun have significantly impacted Raydium’s fee revenue. As noted in our previous report, a large share of Raydium’s earnings comes from memecoin trading, with much of that activity driven by Pump.fun.

When Pump.fun’s live-streaming feature was disabled, their earnings took a 66% hit, dropping by $11.31 million in a single week. This, in turn, caused Raydium’s fees to fall by 40% over the same period. Pump.fun has now been banned in the UK, creating even more headwinds for Raydium.

Meanwhile, Base Chain is making the most of the moment, pulling in an impressive £1 billion in net inflows. Using the same valuation framework that identified Raydium as undervalued, we’ve shifted our focus to Aerodrome Finance (AERO), Base’s top DEX.

With a TVL/FDV ratio of 0.633, Aerodrome is currently more undervalued than Raydium and more importantly their fee revenue is moving in the right direction!

Will Base and Aerodrome sustain their momentum, or is Solana set for a comeback?

Join us next week as we explore the latest Solana DEX shaking up the scene!

Crypto is evolving faster than ever, and staying ahead of trends has never been more crucial. That's why we're here—providing you with the insights and strategies you need to navigate these changes.

DVDealings

A look at our portfolios and our latest trades (paying subscribers only).

Alternatively you can see our strategies on ICONOMI by clicking the buttons below:

Keep reading with a 7-day free trial

Subscribe to CHAINLETTER to keep reading this post and get 7 days of free access to the full post archives.