Welcome to the first edition of the DigitalVision Letter, your weekly guide through the expansive cryptoverse. Here, we not only bring you the latest stories and trends but also provide a look into our investment strategy, evaluations, and real-time portfolio adjustments.

The letter is divided up into three sections:

Across The CryptoVerse. We highlight news and developments that have caught our eye

Digital Insights. A focus on our research work

DVDealings. Our portfolio ideas and trades

Let’s go…!

Across the Crypto-verse: Raydium Protocol’s 250% growth, insight into the team at Maple Finance, and DeSci explained.

Digital Insights: Render Network gets an upgrade, GameFi - Gala Vs Immutable X and is Pyth set to dominate the Oracle market?

DVDealings: Check out the latest adjustments made to our portfolios.

Across the Crypto-verse

Raydium (RAY)

The native token of Raydium, the leading decentralised exchange (DEX) on Solana, has been among the top altcoin performers. Since its listing on 10th October, RAY has surged by over 200%.

In a CHAINLETTER piece published on 12th August, our analysis identified RAY as undervalued.

At the time, its low Total Value Locked (TVL) to Fully Diluted Valuation (FDV) ratio, coupled with improving platform metrics hinted that the token was primed for growth. That prediction has proven to be accurate so far.

But what’s next?

The increasing liquidity flowing into the Solana ecosystem has been a catalyst for heightened activity on Raydium. Additionally, the ongoing meme coin craze hitting new peaks following Trump’s victory has further boosted interest in the platform. Solana’s TVL set an all-time high of $21.5 billion, with Raydium’s TVL also peaking at over $2.6 billion. Although the meme-coin frenzy has started to fade, affecting its fee revenue and trading volume, the strong TVL on the platform is still holding.

We are closely monitoring the liquidity flows in Solana and Raydium, and will keep you informed on major developments.

Maple Finance (MPL)

Maple Finance has featured in several editions of CHAINLETTER. Our conviction in the project not only stems from their fundamentals and on-chain data, but also from our direct communication with the team.

Recently, we observed a pullback in Maple Finance’s Total Value Locked (TVL) and a price retracement followed so we reached out to the team. At the time, they explained that recent withdrawals, amounting to around 7% of deposits, were primarily due to investors reallocating funds to long assets like BTC and ETH. This behaviour is expected and mirrors trends seen earlier in the year.

When we spoke to them on the 15th of November they noted that current outflows were smaller in comparison, highlighting that “93% of capital remains deposited”. However, that has now dropped to 81%. We will continue to closely monitor the level of capital deposited as an indication of the platform’s resilience and growth.

To encourage more deposits, the team is re-rating their loans higher. They typically lock in rates with fixed yield loans. As the market cools down, they anticipate inflows to pick up, similar to the trends observed between March and November of this year.

Our ability to engage directly with the Maple Finance team provides us with a unique edge, allowing us to offer unparalleled insights.

This latest update only strengthens our conviction in Maple Finance’s long-term potential.

Decentralised Science (DeSci) - Revolutionising Research with Blockchain

Decentralised Science, or “DeSci”, leverages blockchain technology to create a more open, transparent, and community-driven approach to scientific research. By decentralising funding, data sharing, and collaboration, DeSci aims to address many of the challenges faced by traditional scientific research, such as lack of funding, slow publication processes, and limited access to data.

Recently, Changpeng Zhao (CZ) of Binance, Vitalik Buterin of Ethereum, and Brian Armstrong of Coinbase attended the Sora Summit to talk DeSci. CZ and Vitalik have been exploring how blockchain can enhance scientific funding and collaboration, while Armstrong has been actively promoting DeSci through his co-founded startup, ResearchHub.

Several DeSci projects have been gaining traction since the summit, with VitaDAO being a standout performer. VitaDAO funds cutting-edge ageing research and democratises ownership of intellectual property, allowing the community to decide which projects to support. Over 14 days between the 4th and 18th of November, VitaDAO’s token, VITA, rose by 690%.

VitaDAO is the second largest DeSci project, yet its market cap is only $103 million!

Psst - we’re still early!

Digital Insights

Render Network (RENDER)

In April 2023 we completed a LITMUS* assessment on The Render Network in which it scored a D. Since then, the team has improved in many areas we believed they were lacking in.

The demand for Render’s services is demonstrated by the consistent uptick in the number of frames rendered by the network. This metric alone is a testament to the addressable market they service.

Following its migration to Solana (SOL), Render Network has upgraded both its speed and scalability, two areas which were previously limited by the Ethereum (ETH) blockchain.

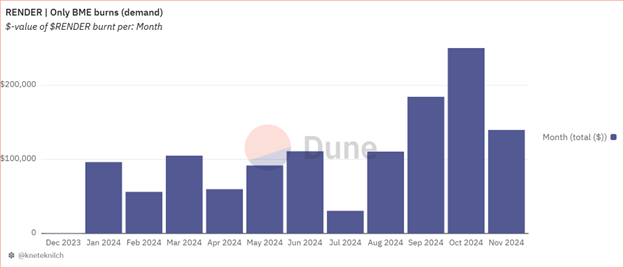

The migration also improved the project's tokenomics by introducing a Burn and Mint Equilibrium (BME) model, in which users pay for services with $RENDER tokens, which are then permanently removed from circulation (or “burned”).

The uptrend in the number of $RENDER burned is another clear indication of the growing demand for their services. Last month's revenue of around $250,000 blows competitors Akash (AKT) and Cudos (CUDOS) out of the water.

The best bit? This is only the start, as the network anticipates increased usage through partnerships with Apple - and the installation of the Octane X app on the latest iPads and Macs as well as integrations with both Dropbox and AWS S3 Cloud Storage.

With improvements in speed, scalability and tokenomics, as well as clear increases in demand for their

services and the growth of their ecosystem, we have upgraded Render Network’s LITMUS score to a B.

Introducing the LITMUS Test:

In our quest to find the gems in the crypto world, we use our proprietary LITMUS research process:

Legitimacy: Ensuring the project has a credible team and clear tokenomics.

Innovation: Does it bring something new to the table?

Technology: Assessing the robustness of the project and the tech behind it.

Market: Analysing market fit and potential for growth.

Utility: How practical and useful is the token or service?

Sustainability: Can it stand the test of time?Each aspect is weighted to derive an overall score from A+ to E.

We only invest in projects scoring B or above. In crypto, what you don’t invest in is as important as what you do!

Stay tuned to see which projects pass the LITMUS test!

Gala (GALA) Vs Immutable X (IMX)

In the world of Web3 gaming, it’s between Gala and Immutable X. The LITMUS conducted in December 2023 scored Immutable X a B. However, when the project announced it was handed a Wells Notice in November it led us to take a closer look at their competition.

Gala's ecosystem spans gaming, film, and music with the $GALA token serving as the gas fee across these platforms. Their burn mechanism has removed 27.5 billion tokens, but activity is currently in decline, and inflation remains high.

With Gary Gensler recently announcing his resignation in January and a more crypto-friendly SEC to come, we are hopeful Immutable’s notice will be rescinded. If not, at least Immutable gets a fair chance to contest it.

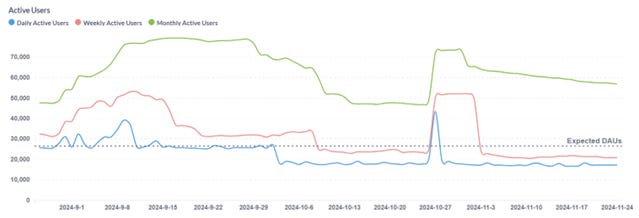

Immutable X's solid team and advanced technology continues to make it a more compelling investment, especially if regulatory clouds clear.

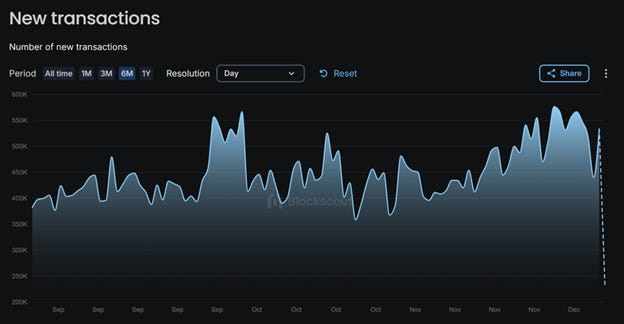

Daily Transactions on Immutable zkEVM

Pyth Network (PYTH)

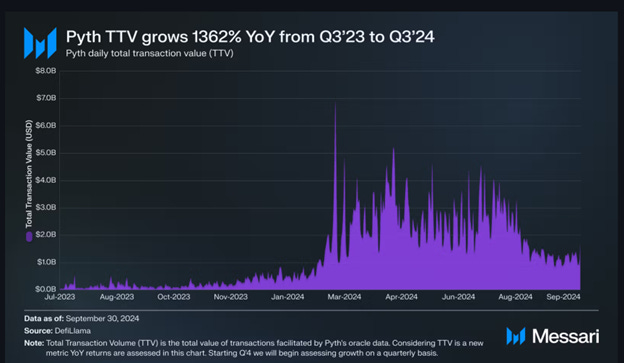

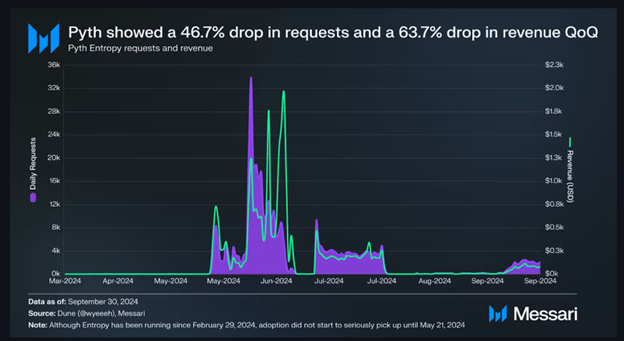

According to Messari, Pyth Network has captured a 50% share of Total Transaction Value (TTV) among all Oracle services, with TTV soaring 1,362% year-over-year to $181.59 billion in Q3 2024 from $12.42 billion in Q3 2023.

Despite Pyth’s dominance both revenue and data requests have declined. While Pyth is a leader in the oracle space, we would like to observe an uptick before adding it to the Digital Vision strategy.

DVDealings

Our two strategies can be seen on the ICONOMI copy-trading platform.

Wistcap Digital Vision is our altcoin portfolio, for investors who want to manage their bitcoin themselves and would like to make an allocation to the rest of crypto. The portfolio will not hold any bitcoin, and it may move into cash or cash equivalents if market conditions are deemed to be unfavourable.

Wiston Flagship Long is our more conservative crypto portfolio, for those who want a managed exposure to the whole asset class. Bitcoin will typically be a minimum of 70% of the allocation, the balance being a selection of our preferred altcoins. The strategy may also hold cash equivalents when market conditions are deemed unfavourable.

So what do the portfolios look like and what have we been up to?

Keep reading with a 7-day free trial

Subscribe to CHAINLETTER to keep reading this post and get 7 days of free access to the full post archives.