Technical and On-Chain

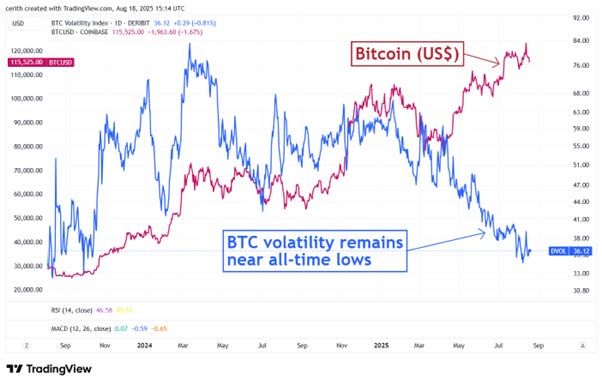

If it’s low volatility you want, by definition you’re going to get dull price action.

Latest thoughts on price action for BTC, ETH - back to accumulation territory

BTC valuation update

Activity by size of wallet - who is buying?

More memecoins for Solana

Technical

Dull August

Sure enough we have another retracement from a breach of the all-time high. This is not a “go-up-in-a-straight-line” market.

And all the better for it, in our view.

August is a strange month for traders. Many are on the beach, replenishing energy for the tasks ahead in the autumn. Liquidity tends to be lighter, market moves flaky. The market floats about like a Hollywood starlet on her fourth cosmopolitan. A lot of bluster, but not to be taken too seriously, and best left alone.

Our year end price target of US$140,000, driven by the trendline in the above chart, seems ever more realistic on this pullback. It suggests the price goes sideways until mid/end September before pushing higher again.

Extended further, that same line takes us into the US$300,000 region by the end of next year, which would correspond to our long held idea that bitcoin should catch up with (and surpass) the percentage of the gold market cap – around 22% - which the World Gold Council deems is attributable purely to investment.

It’s also worth reflecting that bull markets very rarely end with a whimper. We haven’t even got going in terms of bitcoin animal spirits. The most widely referred to sentiment indicator is the Greed & Fear Index. It’s barely got out of third gear in this move, and is back to a limp 60.

Using the colours in the chart, accumulation is best done in the brown and yellow zones, which we’re getting back to now.

The Ethereum conundrum

Ethereum has had a massive bounce in a very short amount of time, more than tripling in just over four months to a high of US$4,700, adding a shade under US$400 billion of market cap in the process. That’s a big number in anyone’s language.

Keep reading with a 7-day free trial

Subscribe to CHAINLETTER to keep reading this post and get 7 days of free access to the full post archives.