Discounts in December - DIGITAL VISION 3

Market corrections like this might feel rough in the moment, but they’re often a blessing in disguise.

Who doesn’t love a holiday discount on your favorite altcoins? Consider this Santa’s gift to savvy investors.

In this edition of Digital Vision, we’ll spotlight some of our top picks and help ease any concerns by showing you that the fundamentals have not changed. In fact, many of these projects are quietly making strides behind the scenes, setting the stage for even greater success.

If you’ve felt like you missed the boat over the past few months, this is your chance to climb aboard. Don’t let this opportunity pass you by. 2025 is shaping up to be an unforgettable year.

Crypto-Verse: Are Fair Launches Redefining Initial Coin Offerings?

Digital Insight: Developers Are Flocking to Solana, Sui, and Near Protocol's AI Boom. DV Favourites Tron, Render, and Aave

DVDealings: We Allocate Our Last USDC, But Where? Subscribe to find out.

Strategy Performance

Note: our two strategies can be copied by investors on the ICONOMI platform. Click on the buttons below the charts to check it out…

WistCap FLAGSHIP LONG - Best ideas including Bitcoin

WistCap DIGITALVISION - Best ideas excluding Bitcoin

WistCap Flagship Long

+109.9% (since launch 27/11/23)

-10.0% (last 7 days)

WistCap DIGITALVISION

+2.64% (since launch 11/11/24)

-17.8% (last 7 days)

Updated portfolios can be seen in the “DVDealings” section at the end of this letter.

Crypto Verse:

Fair Launched Tokens

Fair-launched tokens are distributed equitably, allowing everyone to acquire them at the same fair market price. A prime example is Bitcoin (BTC), which was initially accessible only through mining, ensuring a fair valuation for all participants. In contrast, many new tokens leverage pre-sales and early access events that disproportionately benefit early investors at the expense of retail participants. Venture capitalists (VCs) often exploit this system by acquiring tokens at steep discounts during pre-launch phases and dumping large quantities onto retail investors soon after the Initial Coin Offering (ICO). This practice creates significant price volatility, eroding trust and often leaving retail investors at a loss.

Fair-launched tokens, however, eliminate these inequities by providing equal access during distribution. This approach fosters transparency, community trust, and sustainable growth by removing insider advantages and speculative dumping. Kaspa (KAS) serves as another example, with its fair launch featuring no pre-mines or private sales. This equitable distribution has cultivated a loyal community and steady progress, showcasing how fair-launched tokens can drive long-term value creation rather than fueling short-term speculation.

Digital Insight:

Developer Exodus: Why Builders Are Flocking to Solana, Sui, and NEAR Protocol

Last week, we pointed out how inflows are trending toward Base. At the same time, Solana is solidifying its position as a leading Layer-1 blockchain, often outshining Base’s native Layer-1, Ethereum. This aligns with our perspective at Digital Vision, hence our allocation. (check out the details here).

What’s hard to ignore is the growing number of developers moving to Solana while Ethereum sees a steady outflow, a shift that speaks volumes.

Source: https://www.developerreport.com/ecosystems/solana

Source: https://www.developerreport.com/ecosystems/ethereum

Solana’s Growth and Its Growing Pains

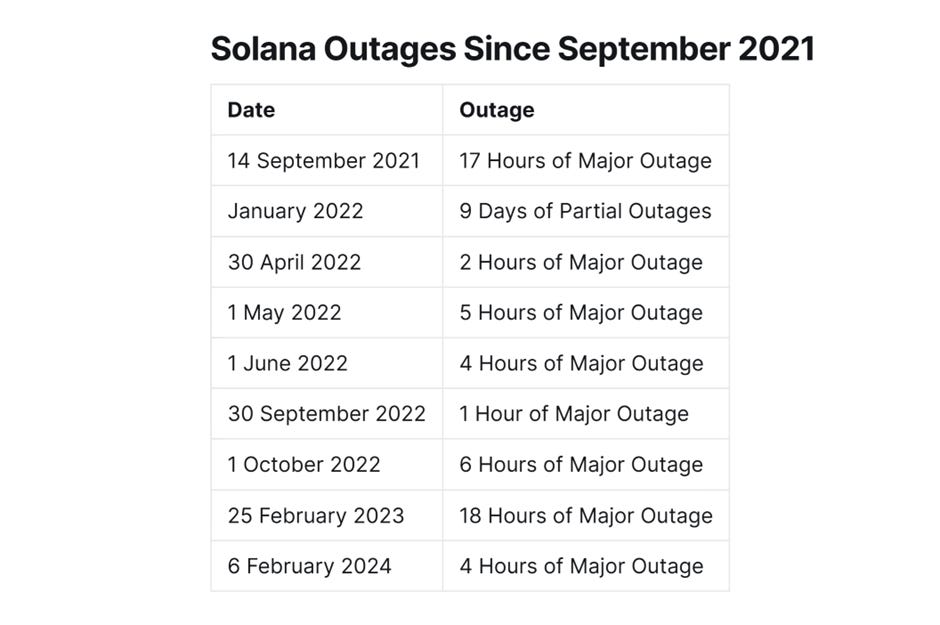

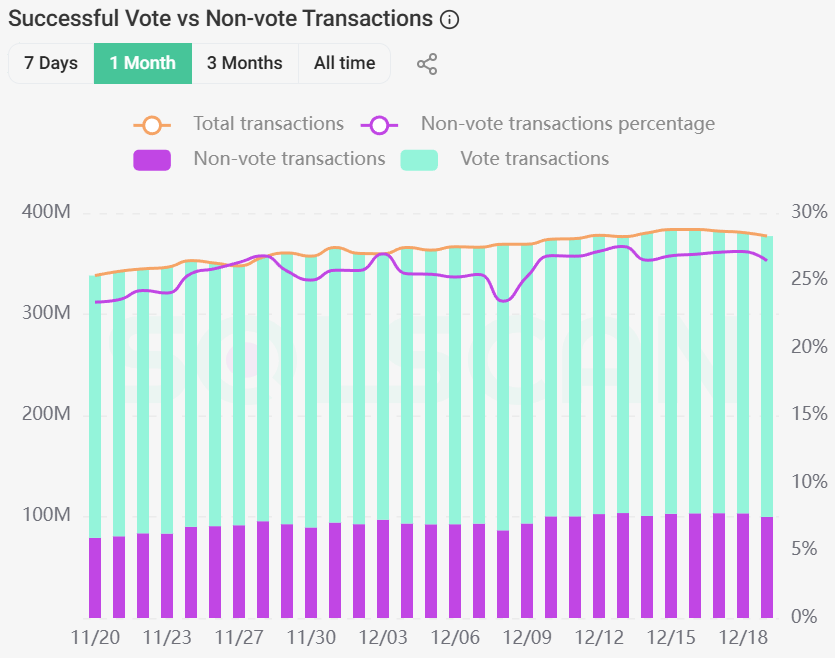

Solana has long been recognised for its speed and low transaction fees. The network handles an average of 4,000–4,500 transactions per second, with peaks reaching as high as 7,229 TPS. However, this high demand has occasionally led to network outages, a problem that’s been hard to ignore.

Source: https://solscan.io/analytics

This is where Solaxy comes in. It’s a newly developed Layer-2 solution designed to reduce the strain on Solana’s mainnet. Solaxy aims to minimise outages and failed transactions while introducing interoperability between Solana and Ethereum. This cross-chain capability could open doors for broader DeFi applications.

In its first week, Solaxy’s pre-sale raised over $3 million, reflecting the growing interest in Solana scaling solutions.

Sui’s Entry into the Spotlight

Layer-1 blockchain Sui entered the spotlight with bold claims of being faster, more robust, and less prone to downtime than Solana. Ironically, despite being dubbed the "Solana Killer," Sui is doing Solana things. On November 21st, the network experienced a two-hour outage following a 300-million-transaction spike. For comparison, Solana regularly processes close to 400 million transactions daily, while Sui typically averages just 18 million.

Source: https://suivision.xyz/statistics

Source: https://solscan.io/analytics

The growing pains are evident, but the increased developer activity on Sui suggests there could be a lot of potential yet to be realised.

Source: https://www.developerreport.com/ecosystems/sui

NEAR Protocol’s AI Push

NEAR Protocol is another network seeing a rise in developer activity. This is largely due to its focus on integrating artificial intelligence into its ecosystem. NEAR has positioned itself as a hub for AI-driven decentralised applications, simplifying the process of building across multiple blockchains.

The protocol’s approach to AI goes beyond development tools. It includes initiatives like AI-focused incubators and privacy-centric solutions like Blind Computation, which help secure AI operations.

Source: https://www.developerreport.com/ecosystems/near

Digital Vision Favourites: Tron, Render & Aave

Tron (TRX): A Layer-1 Powerhouse

Tron’s native token, TRX, currently ranks 8th largest with a $21.8 billion market cap. Over the last year Tron has grown into one of the leading Layer-1’s (L1) in the industry. The majority of the TRX strength came from its strong onchain metrics.

Source: https://tronscan.org/#/data/charts/txn/daily-txn

The daily transactions on Tron have grown consistently since the start of this year. From a low of 3.4 million daily transactions on the 11th of February, Tron is currently processing over 7.8 million transactions, registering a 129% growth. Similarly, the daily number of smart contracts triggered in the blockchain has also experienced a steady increase.

The majority of those transactions are USDT transfers. On average, Tron processes a daily USDT transfer volume of over $20.8 billion, almost 15% of all USDT in existence. The USDT smart contracts calls account for 96% of the overall smart contract calls on Tron. This highlights that Tron has picked a niche (stablecoin payments), which is known to be a niche with a high growth potential.

Source: https://tronscan.org/#/data/charts/tokens/usdt-stats

Additionally, TRX is one of the very few deflationary tokens in the sector. The annualised TRX inflation rate is -2.9%, indicating that even a modest increase in demand could drive the token's value higher.

Source: https://tronscan.org/#/data/charts/trx/supply

Render Network (RENDER): Fueling the Digital World

Render Network has seen a surge in demand for its services over the past five months. The volume of $RENDER tokens burned has grown steadily. This growth underscores the expanding utility of Render Network’s services.

Source: https://dune.com/kneteknilch/rendernetwork-dashboard

One of Render’s recent highlights is its collaboration with Pudgy Penguins, the second-largest NFT collection by market cap. Following a collaboration in December 2023, Render was once again selected to produce the advertisement for Pudgy Penguins. This time for the launch of their native token PENGU, built on the Solana blockchain. The network provided the rendering infrastructure to create the high-quality animations seen below.

https://x.com/rendernetwork/status/1864862447913312752

The token’s launch included an airdrop for over 7 million wallets and quickly reached a market cap of $2.1 billion, generating significant excitement across the crypto community. This collaboration not only highlights Render Network’s technical capabilities but also its growing reputation as a trusted partner for high-profile digital projects.

Aave: A Leader in the DeFi Revolution

Aave has solidified its position as a cornerstone of decentralised finance (DeFi). By offering users the ability to lend and borrow a variety of cryptocurrencies without relying on traditional banks.

What sets Aave apart is its blend of accessibility and strong security. It’s a platform designed with both beginners and seasoned crypto enthusiasts in mind, which explains its growing popularity and staying power in the DeFi landscape.

It’s no surprise that Aave has been a consistent favorite at Digital Vision. The platform continues to deliver steady growth, with its recent performance highlighting its resilience and appeal. The latest data shows Aave reaching an all-time high of $36.46 billion in net deposits and $15.16 billion in active loans. These milestones not only reflect a thriving ecosystem but also Aave’s ability to attract and retain users in an increasingly competitive market.

This consistent growth cements Aave’s status as a standout in DeFi, offering a glimpse into the potential of decentralized platforms to shape the future of finance.

Source: https://tokenterminal.com/explorer/studio/charts/4337cc34-d384-4d07-a438-83404838cb62

DVDealings

A look at our portfolios and our latest trades (paying subscribers only).

Alternatively you can see our strategies on ICONOMI by clicking the buttons below:

Keep reading with a 7-day free trial

Subscribe to CHAINLETTER to keep reading this post and get 7 days of free access to the full post archives.