Crypto returns to work - DIGITAL VISION 4

Crypto reawakens, shaking off the holiday lull and getting back to work.

The holiday season often follows a familiar script for many of us. As the festivities begin, things tend to spiral out of control. By the time Christmas is over, you’re left feeling sluggish, stuffed with food, and unsure of the day, or if it even matters. Then January arrives, and like clockwork, motivation kicks in. Gyms fill up, routines restart, and life gets moving again.

If this sounds like your last couple weeks, you’re not alone. But what I’m really describing is the recent price action in crypto. Just as they say “charts are a mirror of human emotion”, this past week in the market couldn’t have proved it better.

As we step into 2025, we’re kicking things off with a packed edition of Digital Vision. From the latest developments in crypto regulation to standout projects primed to shape the year ahead, we’ve got you covered.

Cryptoverse: EU bans USDT, Michael Saylor rethinks Ethereum.

Insight: PENGU claims meme coin supremacy, DePIN contenders PEAQ and GRASS shine.

DV Dealings: New year, same reliable portfolios.

Subscribe now and stay ahead in what’s already being dubbed “The Year of Crypto.”

Strategy Performance

Note: our two strategies can be copied by investors on the ICONOMI platform. Click on the buttons below the charts to check it out…

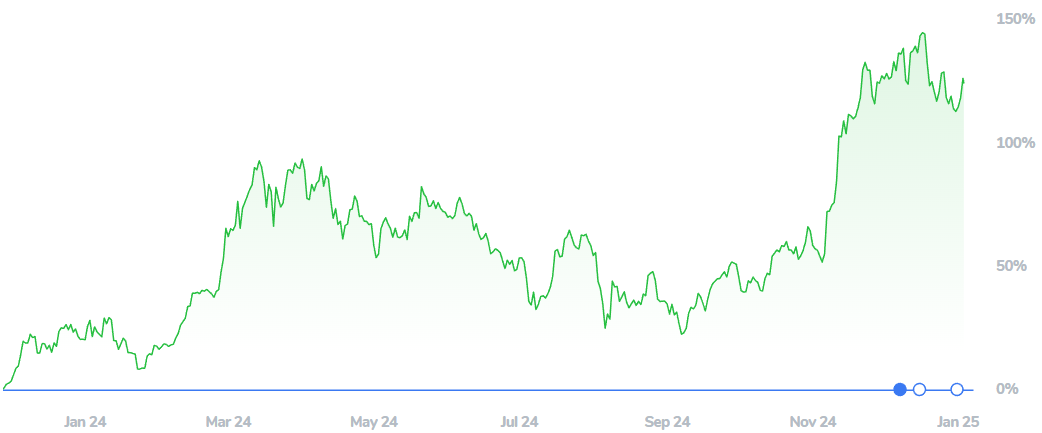

WistCap FLAGSHIP LONG - Best ideas including Bitcoin

WistCap DIGITALVISION - Best ideas excluding Bitcoin

WistCap Flagship Long

+124.08% (since launch 27/11/23)

+1.96% (last 7 days)

WistCap DIGITALVISION

+8.31% (since launch 11/11/24)

+3.52% (last 7 days)

Updated portfolios can be seen in the “DVDealings” section at the end of this letter.

Cryptoverse:

EU Ban on USDT: Opportunity or Overreach?

The EU’s strict enforcement of the Markets in Crypto-Assets (MiCA) framework has effectively sidelined Tether (USDT) from the region. With the stablecoin failing to meet requirements for transparency and 1:1 reserve backing.

MiCA demands stablecoins hold reserves in recognised institutions with high liquidity, such as fiat deposits or easily convertible securities. Tether’s opaque reserve practices and reliance on less liquid assets like U.S. Treasuries and cryptocurrencies have long drawn criticism and now conflict with MiCA’s standards. This has led to many European exchanges delisting USDT pairs.

Globally, the EU accounts for a small fraction of USDT activity compared to other regions like Asia and South America, meaning the ban’s direct impact on Tether is likely minimal.

However, within the EU, MiCA-compliant alternatives like USDC (US Dollar Circle) could gain ground. Ripple’s new stablecoin ‘RLUSD’, using XRP as a bridge, could also benefit from the regulatory shift. For EU investors, these changes promise enhanced stability but at the cost of reduced choice.

While MiCA's robust standards aim to safeguard investors and establish the EU as a leader in crypto regulation, the exclusion of prominent players like Tether might undermine its ambitions.

Alienating projects and constraining activity in the region risks diminishing the EU’s attractiveness as a crypto hub. While the move may be a boost for XRP holders, the region's market share in stablecoin trading could be eclipsed by global competitors, diminishing the broader appeal of becoming MiCA compliant.

Will the MiCA framework attract innovation or will it alienate the very projects that could make the EU a crypto hub? Only time will tell.

Michael Saylor Rethinks Ethereum

Michael Saylor, former MicroStrategy CEO and prominent Bitcoin advocate, has revised his stance on Ethereum. Once dismissive of Ethereum’s prospects, Saylor now sees its potential, acknowledging in an interview with Altcoin Daily that he misjudged its regulatory viability.

His shift coincides with significant political changes following Donald Trump’s presidential return, which Saylor credits with creating a more crypto-friendly environment. “The political landscape and consensus really shifted in the second quarter when Trump embraced crypto,”.

Saylor now envisions Ethereum leading a tokenisation revolution, with the potential to digitise $500 trillion in traditional assets. This outlook aligns with recent institutional moves, such as BlackRock’s exploration of tokenised assets. He also suggested that corporations could adopt Ethereum alongside Bitcoin, broadening crypto’s role in corporate strategies.

This change marks an important moment for Ethereum, highlighting its growing influence in the financial ecosystem. Saylor’s recognition underscores its potential to drive innovations like stablecoins and tokenised securities under a supportive regulatory framework.

Don’t miss next week’s bonus edition of Digital Vision, where we take an in-depth look at the current state of Ethereum. We’ll analyse on-chain metrics and evaluate the validity of Saylor’s new stance.

Digital Insight

PENGU Token Takes Flight

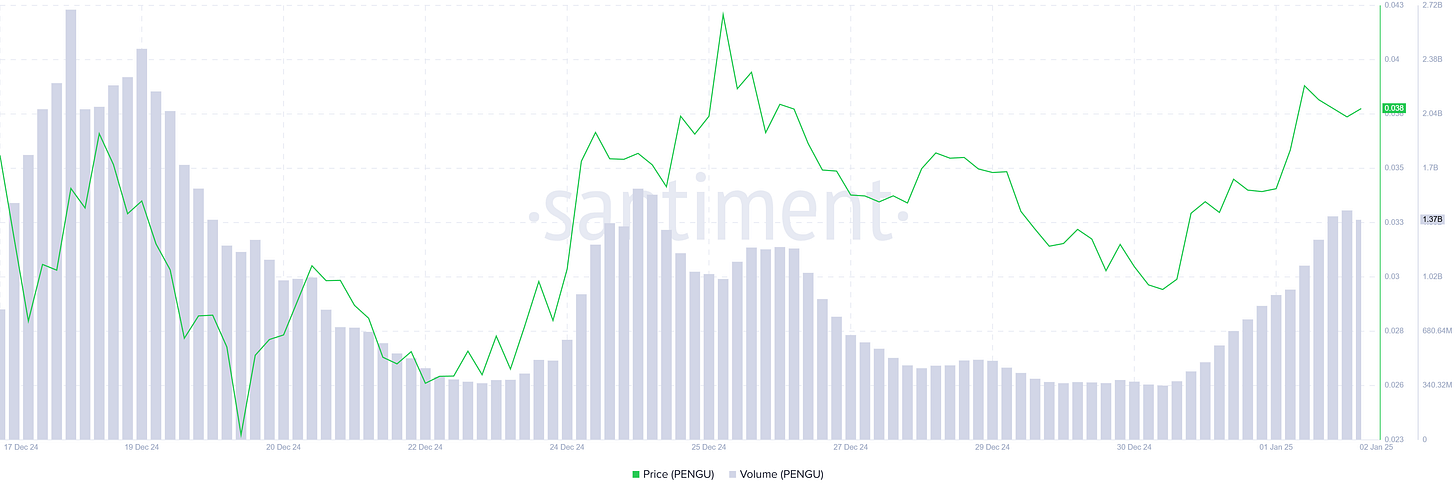

In the last edition of Digital Vision, we highlighted the launch of Pudgy Penguins’ native token PENGU. The token has since been crowned Solana’s top meme coin.

From adorable NFTs to ecosystem powerhouses. Pudgy Penguins launched in July 2021, with 8,888 uniquely designed penguins followed by a later expansion into physical merchandise. Now, the introduction of the PENGU token takes the project beyond NFTs, creating a dynamic ecosystem with governance, staking rewards, and utility across games and exclusive content.

On the 1st of January, PENGU surged 17.5%, challenging BONK to become Solana’s top meme coin with a market cap of around $2.5 billion. Trading volume also jumped 86%, exceeding $1 billion.

Source: https://app.santiment.net/

This rally signals strong investor confidence and sustained market momentum. Unlike speculative price movements, PENGU’s rise is driven by real demand, thanks to its integration with the broader Pudgy Penguins ecosystem. With the RSI resetting from overbought and the price looking ready to break resistance a $0.039, PENGU could be primed for a breakout.

DePIN’s New Contenders: PEAQ and GRASS

In our previous editions of Digital Vision, we’ve celebrated the growing prominence of Decentralised Physical Infrastructure Networks (DePINs) as a standout narrative of this bull run. Projects like Render and World Mobile have already showcased the potential of DePINs. Now, two newcomers, PEAQ and GRASS, are gaining traction with their innovative approaches to bridging the digital and physical worlds.

PEAQ, the DePIN Layer 1 Blockchain

Since its mainnet launch in November 2024, PEAQ has emerged as a key player in the DePIN space, leveraging its layer-1 blockchain to power the Machine Economy, by integrating real-world assets like devices, robots, and vehicles into Web3.

PEAQ has attracted over 50 DePIN projects across 21 industries and connected more than 2 million devices globally. The platform’s modular backend, featuring multi-chain machine IDs and data verification, has been central to its adoption.

PEAQ’s partnerships with leading brands like Bosch, Airbus, and Continental through the Gaia-X initiative demonstrates its focus on mobility and secure Internet of Things (IoT) solutions. Collaborating on decentralised identities and autonomous interactions for vehicles, PEAQ is pushing blockchain's practical application in areas like parking, charging, and logistics.

Its inclusion in Mastercard’s Start Path program further highlights its potential to integrate blockchain with traditional payment systems.

By aligning with global industry leaders and demonstrating scalable, eco-friendly technology, PEAQ has positioned itself as a frontrunner in the DePIN sector.

GRASS, decentralising AI

GRASS is revolutionising the AI data landscape by enabling users to monetise their unused internet bandwidth. Built on Solana as a Layer 2 solution, GRASS allows individuals to contribute idle bandwidth for AI model training. This innovative approach transforms wasted resources into value while democratising data access, challenging the traditional dominance of large corporations in AI development.

The project gained momentum with one of the largest airdrops in Solana’s history, distributing 100 million tokens to 1.5 million wallets. This event sparked a 125% price rise, solidifying GRASS’s presence in the crypto space. With over 2 million active nodes and 2.5 million daily users, GRASS has rapidly scaled, boasting a $770 million market cap, earning them a listings on tier 1 exchanges Bitget and Crypto.com.

GRASS’s appeal lies in its user-friendly ability to combine incentives, community growth, and ethical data sourcing. Its innovative economic model and focus on AI integration have made it a favourite among blockchain and AI enthusiasts alike.

Both PEAQ and GRASS exemplify how DePIN projects are transforming industries by bridging the digital and physical worlds. While PEAQ focuses on enabling IoT and mobility solutions, GRASS innovates in AI data collection and resource monetisation. Together, they highlight the diverse potential of DePINs to reshape technology’s intersection with the real world.

DVDealings

A look at our portfolios and our latest trades (paying subscribers only).

Alternatively, you can see our strategies on ICONOMI by clicking the buttons below:

Keep reading with a 7-day free trial

Subscribe to CHAINLETTER to keep reading this post and get 7 days of free access to the full post archives.