Summary

Technical: bitcoin solid in a range, gold breaks out, Ethereum’s key test

On-Chain: Ethereum mainnet strength, Layer 2s assistance

Macro: rising debt and falling liquidity, inflation latest

Decentralised Disrupters: Maple’s $4bn AUM, Propy unlocks liquidity, a dystopian present (which is not as cool as Michael Caine)

Technical

Bitcoin's Firm Bounce

Our take on bitcoin (as with many things) is that it’s better to be approximately right than exactly wrong. We know why we’re holding the asset for the long term, so it’s important to stay grounded in the short term.

The price retreated back to the December/January highs of US$108,000 and has bounced firmly off that level. As shown below, you’d expect resistance in the short term at the higher of the two dashed lines, but…

… as long as the price bounces off the uptrend we have a constructive set-up as we approach the final quarter of the year. And for no apparent reason, October is frequently a strong month for crypto.

Gold's Quiet Breakout

Gold, which is being acquired for the same reason as bitcoin, continues to motor higher. These are extraordinary moves and there is absolutely no indication of an investor frenzy, as shown by subdued open interest in the lower of the two charts above.

ETF holdings of gold have been trending higher, as shown below. However, it’s worth noting that the last time they were at these levels (September 2022), the gold price was US$1,600/oz. In other words, the price has doubled, and the retail investor hasn’t participated. It’s all been about Central Banks, a source of demand that bitcoin doesn’t have.

Yet.

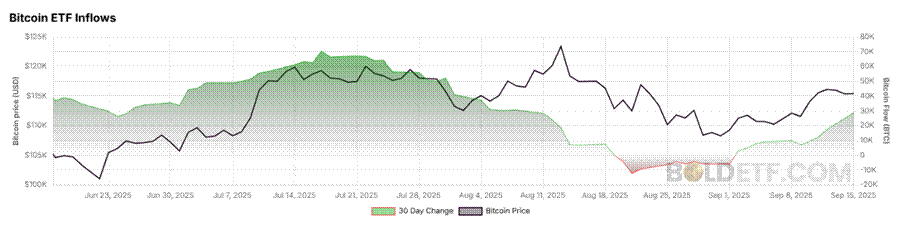

Bitcoin ETF inflows have started to recover from August weakness. Investors are getting back to their desks and they’re buying bitcoin.

ETH's Key Test

ETH has also gone into consolidation mode, both in absolute terms and relative to BTC (below). Thus far it has failed to break above the downtrend line. This will be an important marker of its bid to sit alongside BTC as a reserve asset - and future money - of decentralised finance.

It also suggests that those who are expecting an imminent “altcoin season” shouldn’t hold their breath.

If we are approaching a more cautious market outlook – something we discuss in the Macro section – this is the sort of price action that we’d expect to see. In other words, the higher risk stuff will start to roll over.

In such an environment, you would expect bitcoin’s market share of crypto to recover. It has lost share since early June as ETH dramatically recovered, but over the last few weeks it has stabilised. Is altcoin season over before it began?

Keep reading with a 7-day free trial

Subscribe to CHAINLETTER to keep reading this post and get 7 days of free access to the full post archives.