Bitcoin Holds Firm In A Nervous World

Bitcoin steadies as politics wobble, Wall Street circles, and stablecoins get serious

It’s a nervy time in the crypto sphere, against an unsettled global political backdrop.

We wonder whether regime change would deliver a path to reconciliation between China and Taiwan, and so imbue the former with the global respect to complement its size and influence.

Meanwhile, we weigh in on the argument as to whether bitcoin is a store of value or a means of exchange? It’s quite clearly both, that’s the point of a sound money asset with its own means of communication. Note how it continues to dominate the crypto space.

Wall Street has discovered there’s money to be made from crypto, and it’s not holding back. Expect all sorts of IPOs and a proliferation of holding companies. Oddly it comes at a time when price action in the space is subdued. It probably ends badly, but this time not for bitcoin.

Technical: High-level consolidation and growing bitcoin dominance

On-Chain: A store of value or a means of exchange? It’s both.

Macro: China’s chance to change the Taiwan narrative

Cryptoverse: The Genius Act and the importance of stablecoins

25th June and 16th July - CRYPTO BOOTCAMP in London

Technical

The seven-month consolidation period we guessed at a while back has now been exceeded, but from a technical perspective, that’s not surprising given the extent of the gains in this phase. It would make sense for the price to hit the trendline again before kicking on.

Our expectation remains that bitcoin will close this year significantly higher. If that’s the case, a break-out to a new high is weeks away.

That said, we operate in a two-speed crypto world. Wall St has suddenly gone mad for the boy, while the price action within the space feels distinctly subdued. For all the heralded launches of Treasury companies and a wave of IPO excitement, crypto prices are behaving very poorly.

This can be seen in the fact that Bitcoin’s market share of crypto has again pipped 65%, despite the price remaining below the all-time high.

See also these breadth charts (produced by ByteTree). The blue denotes coins and tokens that are powerfully outperforming bitcoin. It’s about as low as it’s ever been.

Source: ByteTrend

That it comes at a moment when crypto regulation is being eased, and when Wall Street is gleefully finding ways to extract fees from the space, should interest us greatly.

There is something tragicomic about traditional finance’s sudden embrace of the crypto space. Having lambasted it for so long, the lure of fat bonuses is simply too much to resist. Despite the success of the Circle IPO, we suspect it will end badly.

The poster children of this are the Bitcoin Treasury companies. These are listed entities that exist to buy bitcoin, typically financed by new equity or convertible bonds. Michael Saylor of Strategy (MSTR) created the prototype, and most of the rest will turn out to be poor imitations. The model is presented as a way of expressing a short view on fiat currency. They result from the inability of institutions to buy direct or through regulated funds, so this is simply a way of owning bitcoin without admitting that you own bitcoin. It’s the classic distorted outcome of poor regulation.

These now spring up on an almost daily basis, normally born of some failing entity that needs to resuscitate its share price. Note in the chart below that the number of entities (top right) has grown by over 10% in the last 30 days alone, and the amount of BTC now kept in a treasury structure of one form or another has grown 3.8% over the same period.

Source: BitcoinTreasuriesNet

Why hasn’t the price gone up more if all these institutions are buying? Good question!

Over the last 30 days, the chart above shows that BTC holdings by institutional entities gas grown by 3.83%, which is approximately 102,000 coins. Removing the 450 newly minted coins per day (13,500 over 30 days) and somehow 88,500 BTC (market value ~US$9.3bn) have been found without affecting the price.

That’s pretty remarkable. The logical source is large, long-term holders (whales or miners) locking in gains (as opposed to growing short positions), but they could be doing one of two things. First, obviously, simply selling directly to new buyers and heading off to the superyacht shop. Secondly, they could be taking some sort of equity stake in a listed vehicle, with the understanding that they will transfer existing bitcoin holdings into the new vehicle. Thereby, they get the equity lift (offsetting capital gains tax on the underlying), which they can sell to new investors at a multiple of book cost. Disclosure: that’s a pure guess on my part, but you can see the attraction of such a structure to a long-term holder, and it would also explain the lack of price movement in BTC because there would be little in the way of change in the underlying ownership.

At the margin, however, this implies that we are at a point where there is a reduction in bitcoin owners who know and understand what they own, and an increase in those that don’t. If you’re buying bitcoin holding companies for a punt on other people bidding the shares to a great premium, you’re not likely to hang around if it goes wrong. What odds we’re able to buy these companies at discounts in a couple of years’ time?

Bitcoin seems to be good at understanding the fragility of ownership. It will be interesting to see what happens when this treasury company craze dies down. Bitcoin will be fine – there’s no obvious selling pressure that emerges from this, although sentiment would take a knock. But once again, egg will be plastered all over the faces of the investment bankers who took advantage of gullible investors. Not that it will stop anyone from blaming bitcoin, mind you.

On-Chain

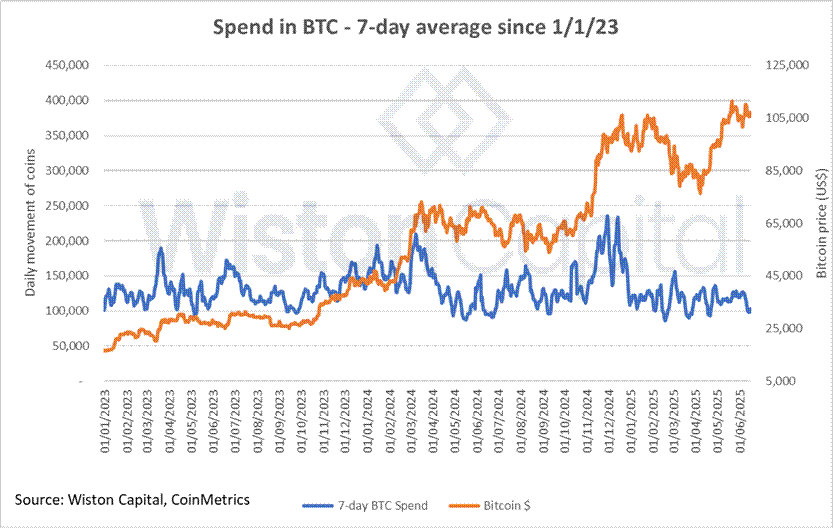

Once again, we report very low-key activity on the Bitcoin Network. The amount of BTC changing hands (blue, below) is at a low ebb.

There is an ongoing debate in the space between those who see bitcoin primarily as a store of value (“digital gold”) and those who see it as a means of exchange or payment.

But why does it have to be one or the other? If you consider the technology, the whole point is that it can be both. Gold fails as a medium of exchange because it is hard to fractionalise and hard to move around. Fiat currency, on the other hand, fails as a store of value.

Bitcoin’s singular beauty is that it is both a store of value and a medium of exchange. There are 100,000,000 sats in a bitcoin, it transacts and settles instantly on the internet (the moving charge is tiny) and there will only ever be 21 million of them.

Right now, it makes sense for people to store bitcoin, because these characteristics suggest it will be more widely adopted in future, which in turn means that we are still in the early stages of its price appreciation. So why spend it?

Another way of thinking about bitcoin is to use it as collateral and borrow against it. This means investors can take advantage of its core qualities without creating a taxable event. In this way, it will have the appearance of a store of value, but the utility as a means of exchange.

Macro

The exit of Xi Jinping would pave a path to global peace

These are momentous times.

While missiles are darkening Middle Eastern skies, I was struck by this article which appeared in The Spectator: “Is Xi Jinping’s time up?”. It hints at the possibility of his replacement in the not-too-distant future, and presents a fascinating – and optimistic - possibility. I will return to this.

We live in an age of three parallel geo-political fault lines. In all three cases - China/Taiwan, Iran/Israel and Russia/Ukraine - a large, autocratic regime with rigid ideological and territorial claims has a stated aim to either subsume or destroy a small, free, democratic nation on their doorstep, against their will.

Of course, the back stories vary, and the claims have a varying degree of historic and legal legitimacy. But ultimately, it’s the same tale. Does the playground bully get his way? Or does the little guy fight back, with the help of friends who are prepared to stand up and fight for what’s right?

In the case of Israel, it’s clear that their only option was to pre-empt Armageddon. It is quite clear that the men who lead Iran wish Israel to be wiped from the face of the earth. That was the unequivocal message from the 7th October attacks. So, which is a higher risk option? An assault to cripple your bitter enemy’s ability to destroy your entire country, or a reliance on the fruits of negotiation while your cruel, theocratic, mad enemy builds nuclear weapons? It is an absolute no-brainer to select the former.

The months since Trump’s election victory, and his misplaced confidence in delivering peace, have coldly revealed Vladimir Putin’s true colours. He has no interest in peace. He only wants Ukraine back in the fold. He is prepared to send hundreds of thousands of young men to their deaths to achieve that aim. This is Russia’s history encapsulated in the present day. To understand it we have to realise that their mentality is different. This is well articulated in this short piece by podcaster Konstantin Kisin.

Ultimately, this only ends well if and when the good guys help the little guy turn the military tide.

Wisdom and maturity can change the Taiwan narrative

This is where we return to the Xi story. The current Chinese President has painted himself into a corner over Taiwan. He has made the annexation of Taiwan a marker of the success of his tenure. The recovery of Taiwan is woven into the mentality of the Mainland Chinese as a necessary act to correct historic grievances.

Owing to the historic spinelessness of Western democracies in their efforts to ingratiate themselves with the world’s next superpower, this claim has almost become deemed acceptable. Yet it is clearly not acceptable to the Taiwanese people, and in truth the claim is flimsy at best. It is 130 years since Taiwan was last under Chinese rule, since when it spent 50 years as a Japanese colony and most of the rest as a peaceful, independent, democratic and hugely successful country. Surely China is now grown-up enough to recognise that time has moved on, and it’s time to accept things as they are. Mutual respect, cooperation and friendship would be far more powerful than conquest.

China is far happier and healthier at the moment than is popularly understood in the West. The typical projection is of a country on the edge of collapse, overseen by a dystopian thought police, riddled with poverty and pollution. Yet the opposite appears to be the case. Cities are clean and green, crime is minimal, technological progress is off the charts. From an economic perspective, China’s hoarding of gold gives the appearance of a nation finding a way for a return to the discipline of sound money. Bitcoin will inevitably play a part in that framework.

If this is the case, China starts looking like the grown-up in room. It’s not as though it has to be aggressive towards the USA either (and nor has it been). As Napoleon said,

“Never interrupt your enemy when he’s making a mistake.”

But that would change if Taiwan was invaded. It would be devastating on so many levels: there would be the cost of many lives, of course, but also a massive disruption to business, and a huge cost to relationships in and around the region, let alone the danger of unanticipated consequences. First Taiwan, then what? Where does this stop?

That’s why it wouldn’t be a surprise if there were powerful factions – including perhaps, the younger generations – who don’t regard the annexation of Taiwan as the be-all and end-all. Does the army really want to risk sending many thousands to their deaths? Does the business community want wrecked relationships both with Taiwan and elsewhere? Do the most senior members of the Communist Party want to risk their reputations on something that could turn very nasty?

The way to tiptoe back from such a drastic move would be to pin the issue on Xi Jinping, and then quietly usher him out of the way. This would lay the groundwork for redefining the cross-Straits relationship within a less confrontational framework. It would be immensely positive for China’s international standing and transform investor attitudes.

My Chinese contacts generally think this is Western media baloney, and obviously Xi won’t let go without a struggle. But, but, but… there’s surely something here that makes sense.

How good would that be? Two of our three Goliaths being tamed before year end.

Now for you, Vlad.

Liquidity Slows

The latest from liquidity gurus Crossborder Capital is that global liquidity continues to slow. More detail can be found here

For our purposes the important observation is that cryptocurrencies tend to lag global liquidity by around three months. That would point to a loss of momentum in the third quarter if the liquidity rollover extends from here.

Our sense is that “crypto” is already sensing a tighter environment, although this might also have something to do with competition from the crypto equity frenzy. Animal spirits are low and a lot of the speculative heat is coming out of the system (as discussed in the technical section).

“Bitcoin”, on the other hand, is rock solid. The distinction, as ever, is supremely important.

25th June and 16th July - CRYPTO BOOTCAMP in London

CryptoVerse

GENIUS Act Passes: Stablecoins Finally Get the Framework They’ve Been Waiting For

It’s official. On June 17th, 2025, the U.S. Senate passed the GENIUS Act—short for Guiding and Establishing National Innovation for U.S. Stablecoins. It’s the first fully fleshed-out piece of federal legislation aimed at stablecoins, and arguably the most important regulatory milestone the crypto industry has seen to date.

For years, stablecoins have lived in a grey zone, used daily by traders, institutions, and protocols, but operating without clear rules in the world’s biggest economy. That changes now.

What’s Actually in the Bill?

The GENIUS Act puts structure around how stablecoins are issued, managed, and regulated in the U.S.

Key provisions include:

1:1 Reserve Backing: Stablecoins must be backed with cash or equivalents at all times. No excuses, no leverage games.

Transparency: Issuers must publish monthly reserve disclosures and submit to regular third-party audits.

Regulatory Tiers: If your stablecoin has a market cap under $10B, you fall under state oversight. Go bigger, and you’re federally regulated.

Consumer Protections: If an issuer goes under, stablecoin holders take priority over other creditors.

AML/CTF Compliance: All issuers must meet existing anti-money laundering and counter-terrorism financing rules.

Foreign Issuers: Non-U.S. stablecoins can operate in the States, but only through approved, Treasury-compliant service providers.

For users, nothing changes. You can still hold, transfer, and use stablecoins freely. But behind the scenes, the industry now operates under a clearly defined rulebook.

The Bigger Picture: A Win for the Entire Sector

This isn’t just about compliance, it’s about credibility. Stablecoins have grown into a $200 billion market largely without help from regulators. With this bill, they're no longer fringe tools; they’re now recognised infrastructure for payments, settlement, and store of value.

The GENIUS Act is also likely to unlock further institutional growth. Analysts are already projecting the stablecoin market to grow exponentially as regulation brings in new capital. By defining what stablecoins are and how they can operate, the U.S. has sent a clear message: we’re open for business.

Wall Street Enters Stage Left

The ink wasn’t dry before JP Morgan made their move. Just a day after the Act passed, the bank announced the launch of its own U.S. dollar-pegged stablecoin, aimed squarely at institutional clients.

Backed by cash and equivalents, and only accessible to approved players, it’s not a decentralised option, but that’s the point. JP Morgan’s stablecoin operates within a permissioned system, ticking every regulatory box from AML to CTF.

And that’s by design. Big banks aren’t trying to displace crypto; they’re building regulated rails for their clients to move capital faster and cheaper, especially across borders.

What It Means for Permissionless Stablecoins

While JP Morgan’s entry adds legitimacy to the space, it also shines a spotlight on existing players like Circle and Tether.

The GENIUS Act doesn’t outlaw open-access stablecoins, but it does set expectations. Those that meet the new standards around reserves, transparency, and auditability will stand out. Those that don’t? The gap between institutional and retail trust may widen.

Still, the narrative shift benefits everyone. Permissioned and permissionless models serve different users, but they now operate under a shared framework.

Final Thoughts

The GENIUS Act is the regulatory clarity stablecoins have needed for years. It's a sign the U.S. is serious about crypto infrastructure, not as a threat to the system, but as part of it.

With Wall Street stepping in, stablecoins are no longer niche. They're going mainstream. And if early moves from JP Morgan are any indication, we’re only at the start of what that might look like.